Below is an excerpt of a few slides from a recent presentation to our Board Compensation Committee about our employee equity strategy. I know a lot of CEOs and Heads of People are wrestling with how to create an equity refresh strategy. I’m sharing ours in the hope that it will help others.

As companies grow, their equity stack grows faster than their debt stack. Equity compensation is one of the strongest tools a company has to create long term alignment between the employee and the company because it aligns the employee’s short term interest with the long term interest of the company. Said differently, making employees owners gives all employees the same incentives and motivations that you have as CEO.

Our equity program has four components, shown below.

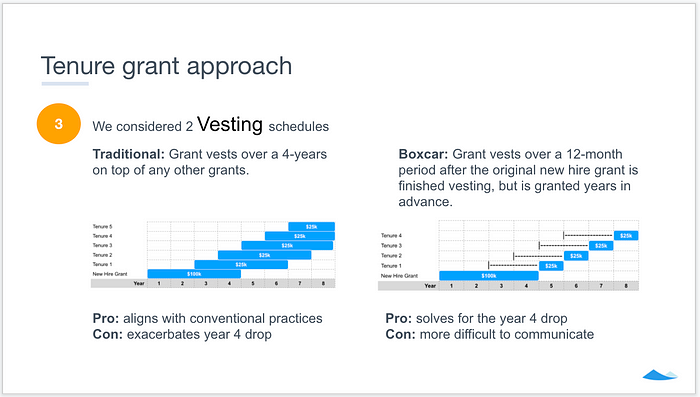

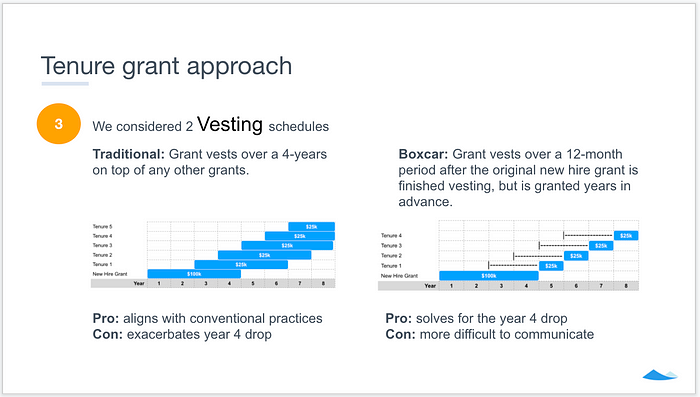

The equity grant structure we all use today was created when the average time to exit for a company was 4–5 years. That is why most vesting schedules are 4 years. Today the average time to exit is over ten years, but we’re still using standard four year vesting schedules. Tenure grants serve to retain employees beyond the initial four year vesting period.

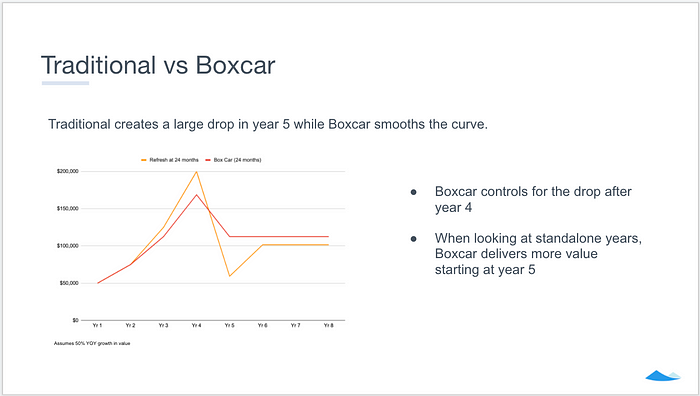

Most private company equity refresh programs utilize the traditional vesting schedule shown above, layering four year vesting grants on top of each other. The result is a sharp drop-off in equity value in year 5 of the employees tenure. That is one reason you see employees leave after their initial grant vests. They will never make as much equity as they did in year 4 of their employment.

We chose a different approach. Boxcar grants control for that drop off in year 5, and reward employees who stay at Carta for more than four years. These grants are issued annually, starting in year 2, and vest over the course of one year. The vesting period begins two years from the grant date, so a grant given in at the end of year two begins vesting at the end of year four. By issuing the grants two years in advance we allow our employees to take advantage of the growth in company value they are helping to create.

For our performance grants we utilize the traditional four year vesting schedule because we want the impact to begin immediately. These are layered on top of the initial equity grant and subsequent boxcar grants.

Role changes grants are perhaps the most difficult for companies to navigate. If the company has grown in value, so has the value of the employee’s initial equity grant. Depending on the scale of that growth, an employee may already be vesting more equity value than a new hire would receive. Most equity programs wouldn’t issue additional equity to the employee in this situation, which makes sense from the company’s perspective but not from the employee’s.

To solve this, our role change grants are equal to the difference between the midpoints of the level the employee is moving from and the level the employee is moving to. That means that no matter how much the value of the employee’s equity has grown, they are getting the same additional value for their promotion. This means early employees aren’t inadvertently penalized later in their tenure.