An equity refresh grant is a stock grant issued to tenured employees. Equity refreshes help retain top performers and offset the costs of recruiting.

Most startups grant equity compensation to new hires as part of their overall compensation package to incentivize them to join and stay at a company. But what about rewarding and incentivizing employees who have been at your company for a few years? Recruiting and training new employees is costly, so it’s important to have strategies—like equity refresh grants— in place to retain your top performers.

Since equity is such a powerful tool for employee retention, it makes sense to grant equity throughout an employee’s time with your company, not just when they’re hired. An equity refresh is a stock grantissued to employees who have already received a new-hire grant (equity that’s granted to an employee when they first join a company).

While refresh grants are always aimed at employee retention, there are three main types of refresh grants.

These grants are given to employees when they reach a set tenure milestone or are completing vesting of their new-hire grant. These are aimed at retaining employees beyond the cliff of their new hire grant and are generally issued when the initial grant has vested at least halfway.

Issuing refresh grants at a predetermined cadence makes it easier to forecast how these grants will impact your equity pool, which can minimize dilution. It can also help with retention since employees know that they could receive more equity if they stay for a set period of time.

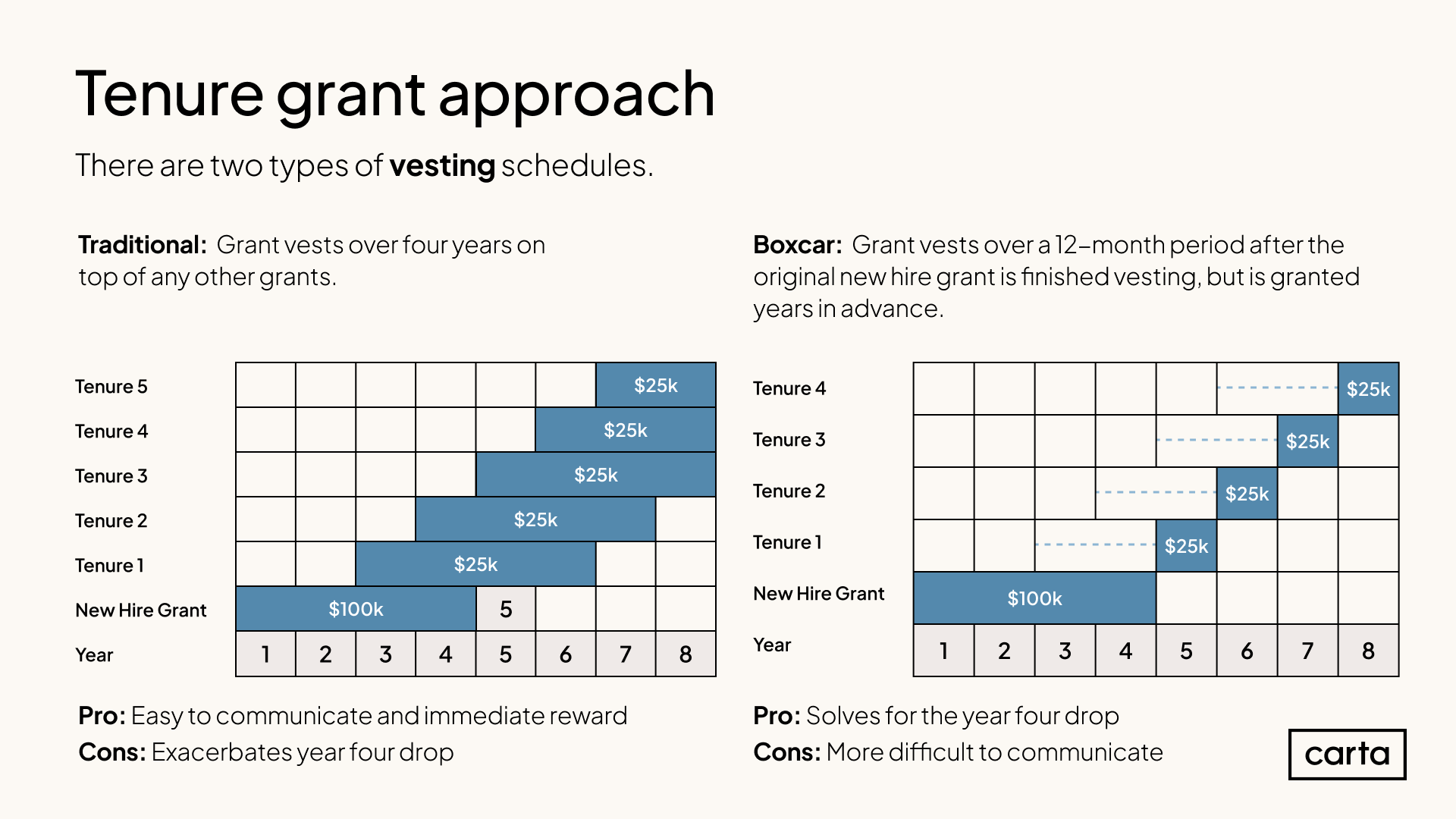

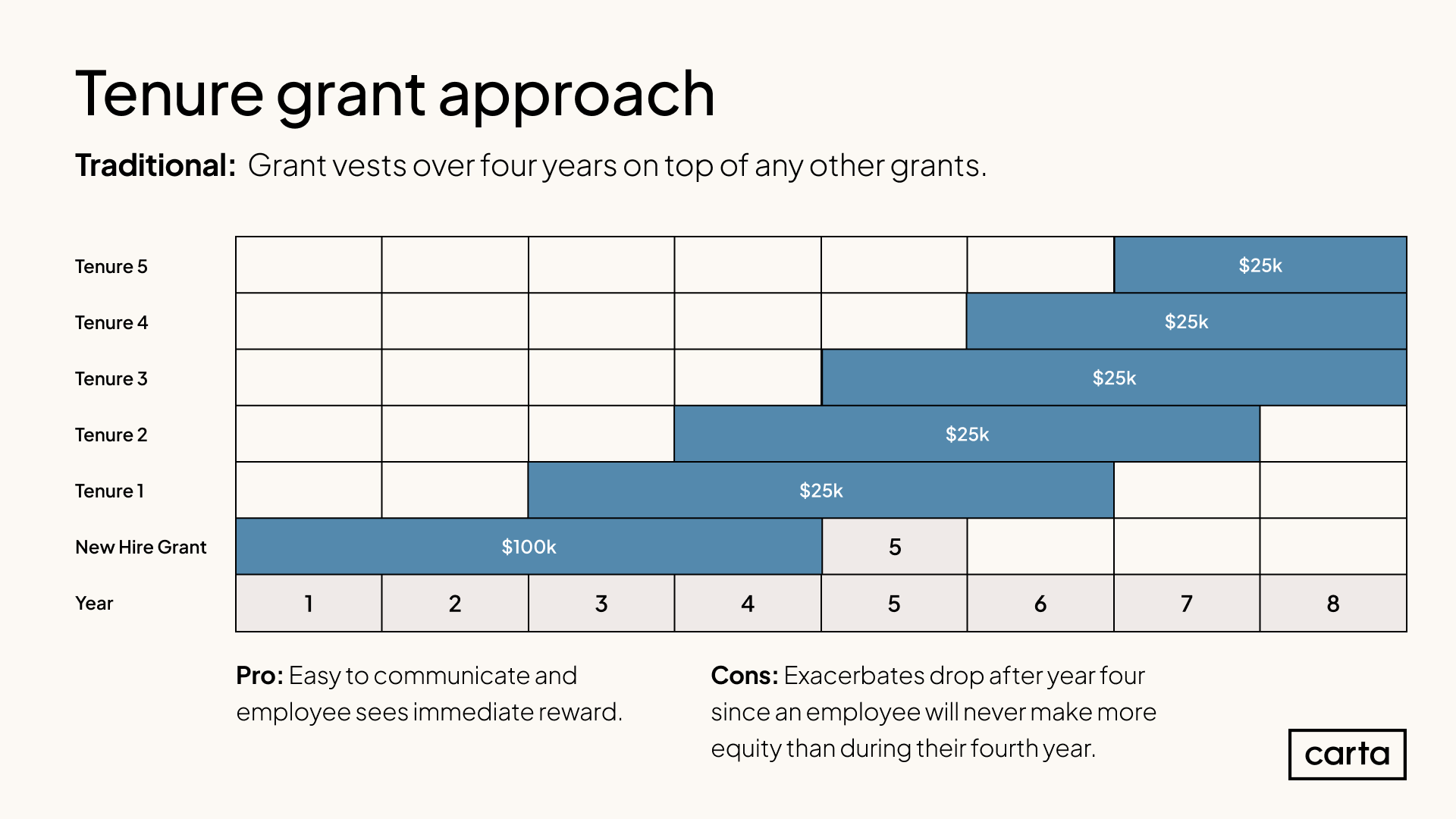

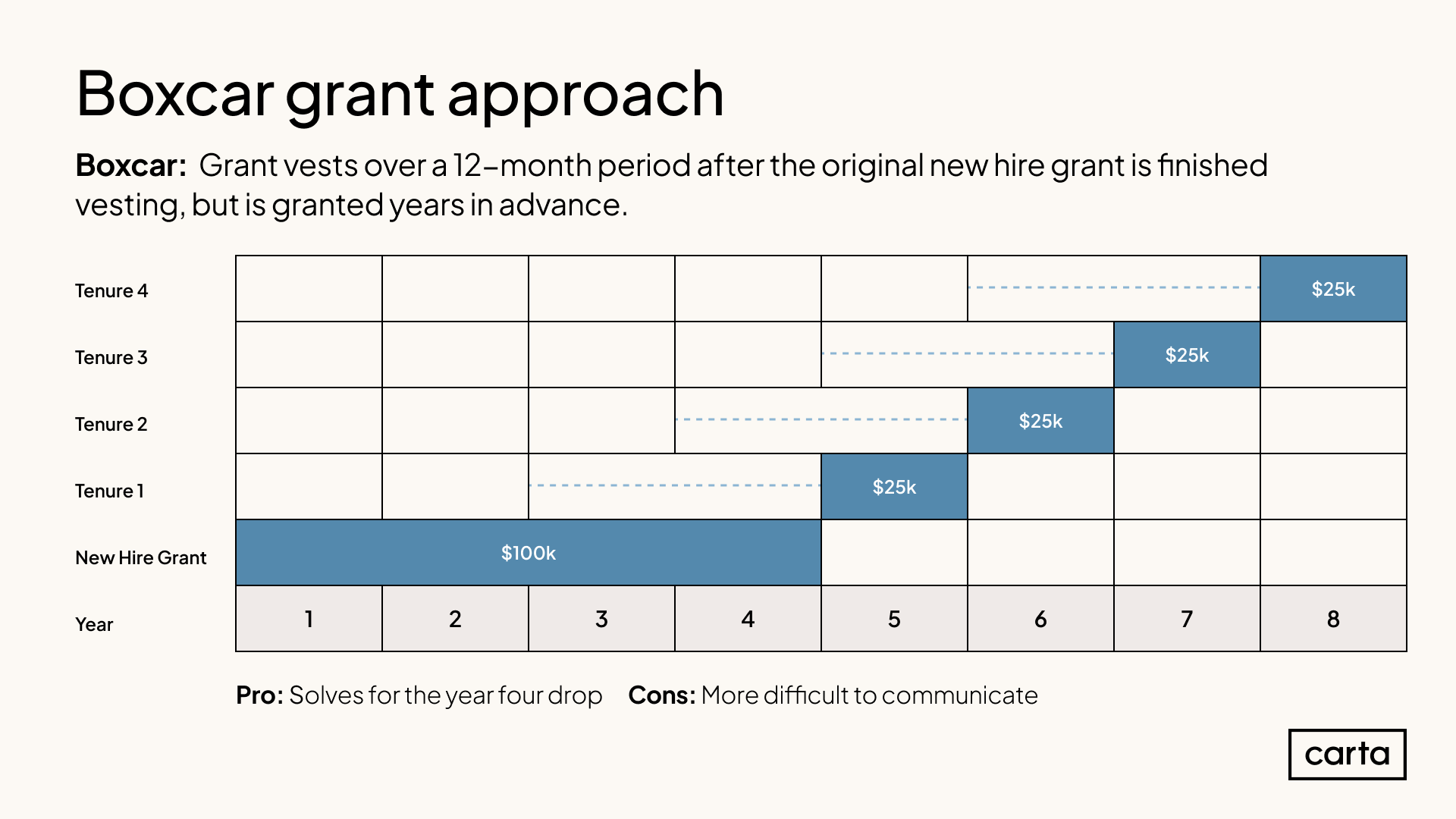

There are two main ways to structure a time-based refresh grant:

Tenure grant approach (1)

Some startups treat equity refreshes like yearly salary raises and give a standard increase to all employees to stay competitive against the market. These grants start vesting immediately and vest over either one or four years on top of any other grants. As a business, this is easier to budget equity for but it can exacerbate the drop-off after year four because employees will never earn more equity than they do during their fourth year.

Traditional (2)

You grant equity to an employee at year two or three, but the new grant only starts vesting once the new hire grant is fully vested (after year four). These grants vest over one year vs. a traditional grant that vests over four years. This method avoids overlapping vesting periods while ensuring employees can take advantage of a lower stock option strike price and potentially pay less in taxes if your company valuation continues to rise.

Boxcar (1)